Finance

Markets Wrap Up After NVIDIA Home Run Rally

Finance

Cramer Top 10 Things To Watch In The Stock Market

-

All Scholarships1 year ago

All Scholarships1 year agoMedhasoft Bihar Scholarship 2023-24 Online Apply, Status | medhasoft.bih.nic.in

-

SSP Scholarship1 year ago

SSP Scholarship1 year agoSSP Scholarship 2023-24 | Apply Online, Last Date, Procedure | @ ssp.karnataka.gov.in

-

SSP Scholarship1 year ago

SSP Scholarship1 year agoSSP Pre Matric Scholarship 2023-24 | Check Latest Updates and More

-

All Scholarships1 year ago

All Scholarships1 year agoBihar Board 10th Scholarship 2023-24 | Student List, Apply Online

-

All Scholarships1 year ago

All Scholarships1 year agoMP Post Matric Scholarship 2023-24 | Apply Online, Eligibility Criteria, Last Date

-

All Scholarships1 year ago

All Scholarships1 year agoBihar Board Matric 1st Division Scholarship 2023-24 List | Online Apply, Last Date, Eligibility

-

All Scholarships1 year ago

All Scholarships1 year agoBihar Scholarship 2023-24 | Eligibility, Check Status, Apply Online, Last Date

-

All Scholarships1 year ago

All Scholarships1 year agoDSW Scholarship MSU 2023-24 | Eligibility, Apply Online, Last Date

-

NSP Scholarship5 months ago

NSP Scholarship5 months agoNSP Scholarship Merit List 2023-24

-

All Scholarships1 year ago

All Scholarships1 year agoBihar Inter Scholarship 2023-24 (12th) | Eligibility, Apply Online, Student List

-

All Scholarships1 year ago

All Scholarships1 year agoKotak Kanya Scholarship 2023-24 | Eligibility, Apply Online, Last Date

-

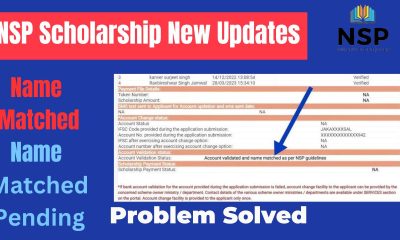

NSP Scholarship5 months ago

NSP Scholarship5 months agoNSP Scholarship 2023 Name Matched As Per NSP Rules